The government of Uganda is going through the bids that were submitted for the concession to take over the Kilembe Mines, as the country looks to revamp the production of copper and cobalt.

Uganda closed its call for bids on May 10, with sources telling us that 14 companies showed interest in the Kilembe project, a drop from the roughly 23 that had shown interest two years ago.

However, the spokesperson for the Ministry of Finance, Planning and Economic Development, which is overseeing the selection process, declined to share the names of the companies, imploring us to await the official release of the list – which, according to the bid documents will be at the end of June, 2022.

Our sources claim mining major Glencore, which mines and processes copper in Africa, Australia and South America was one of the companies that submitted a bid. The others are Gingko Energy Company from China that also bid for Kilembe in 2012, China Railway No10 Engineering Group and a company associated with the Wagagai Gold establishment in Busia, Eastern Uganda.

Australia’s Jervois Mining, which has in the recent past carried out significant exploration work in Uganda for copper and cobalt including in areas neighbouring Kilembe, is also one of the bidders.

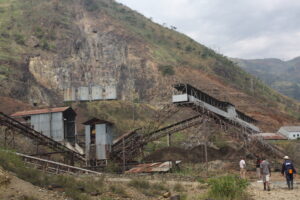

The workshop at Kilembe

Unfriendly Mining Bill

It is not yet clear why only a few companies have bid for Kilembe this time but it is possible that the Mining and Minerals Bill 2021 that was passed by the Parliament of Uganda in February this year is part of the reason.

After its passing by Parliament, the Uganda Chamber of Mines and Petroleum (UCMP) petitioned President Yoweri Museveni over provisions in the Bill, which it claimed were likely to “discourage investment in the country’s mining sector especially in the exploration and quantification of our mineral reserves.”

These included ‘State Participation’, where by the state will be entitled to up to 15 per cent free carried interest from exploration to production in any large or medium scale project, a move that the UCMP said was akin to double taxation.

The Chamber is also unhappy with the ‘Production Sharing’ provision in relation to any large or medium scale project, with the Bill not explicitly stating how the provision would be implemented in practice.

The production sharing model was also inappropriate for mining, as it had not worked in any country globally, often discouraging private sector investment in the sector, the UCMP argues.

Battery Minerals

There is a growing global demand for electric vehicles and with this, the value of clean energy or battery minerals – including cobalt, lithium, graphite and nickel – used in the production of lithium-ion batteries that are used to power the cars.

Norway plans to have banned combustion engines by 2025 and many other countries have instituted similarly ambitious targets in order to reduce fossil fuel emissions.

In response to these developments, carmakers are increasingly adding new models of electric vehicles to their production lines, subsequently growing the demand for cobalt and nickel.

Clean energy minerals are, however, not only needed by the electric vehicle industry but by the ‘Green Revolution’ as well. All the metals that go into making wind turbines or solar panels such as aluminum, copper, graphite, rare earth elements, for example, are in demand.

Kilembe copper ore

Uganda stands to benefit from this global appetite for clean energy minerals if it turns its significant production potential into reality. Apart from the copper (and cobalt) reserves at Kilembe, the country also has nickel and copper exploration ongoing in Kitgum and rare earth elements (REEs) exploration in Makuutu in Eastern Uganda. Others include graphite and nickel projects in West Nile.

Kilembe Potential

Incorporated in 1950, Kilembe Mines Limited (KML) is jointly owned by the Government of Uganda (99.99 per cent) and the Estate of the late Rukiidi III, the Omukama of Tooro Kingdom (0.005 per cent). In the 1960s, the minerals’ industry, led by KML, contributed about 30 per cent to Uganda’s gross domestic product (GDP).

Managed by Canadian firm Falconbridge, KML operated a copper and a cobalt mine in Kasese and a copper smelting plant in Jinja from 1956 to 1982 when mining ceased due to depressed world copper prices. Since then, KML has operated on a care and maintenance basis.

Derelict infrastructure at Kilembe

Its assets include minerals and mining rights, land and buildings, plant and machinery, timber treatment plant, foundry and electrical workshops, a 5MW hydroelectric power plant, lime works and several tailings dams with cobalt content. It also holds a 25 per cent share in Kasese Cobalt Company Ltd.

An ore reserve in the “proven” and “probable” categories of 4.1 million tonnes grading 1.77 per cent copper remained unexploited in 1982, on top of the unexplored ore on the rest of the 2,000 acres of the mining lease. Whoever wins the bid to develop Kilembe is expected to verify the mineral reserves data and carry out more exploration on the license.

The new investor will also be expected to set up refining plants that will produce pure metals (cathodes), which can be used to manufacture finished products like copper wire.

Unfortunately, the only company that has attempted to revive Kilembe in recent years – the Tibet-Hima consortium from China – had its 25-year concession agreement terminated in 2017 only four years after it was granted, with the investors accused of failing to fulfill crucial contractual obligations.

Uganda is targeting a production of 2,000 metric tonnes of copper within five years, not only from Kilembe but from other prospective areas around the country that were captured during the airborne geophysical surveys.

Before resuming copper mining at Kilembe however, a permanent solution to the River Nyamwamba seasonal floods will need to be implemented.

After the last spate of floods in May 2020 – the third time in seven years – it was estimated that up to $60 million was needed to repair the inconsiderable damage to infrastructure, they had left in their wake.

(This story has been updated to indicate that Jervois actually put in a bid; and that 14 companies participated in the process)